A Year in Review: 2025 & Looking Ahead

Is it really February already? If 2026 moves as fast as 2025 did, Id say we are in for a wild ride. Fortunately, the real estate market is showing signs of a much steadier pace. In this month’s update, we’re recapping the defining trends of 2025 and looking at what the experts are projecting for 2026.

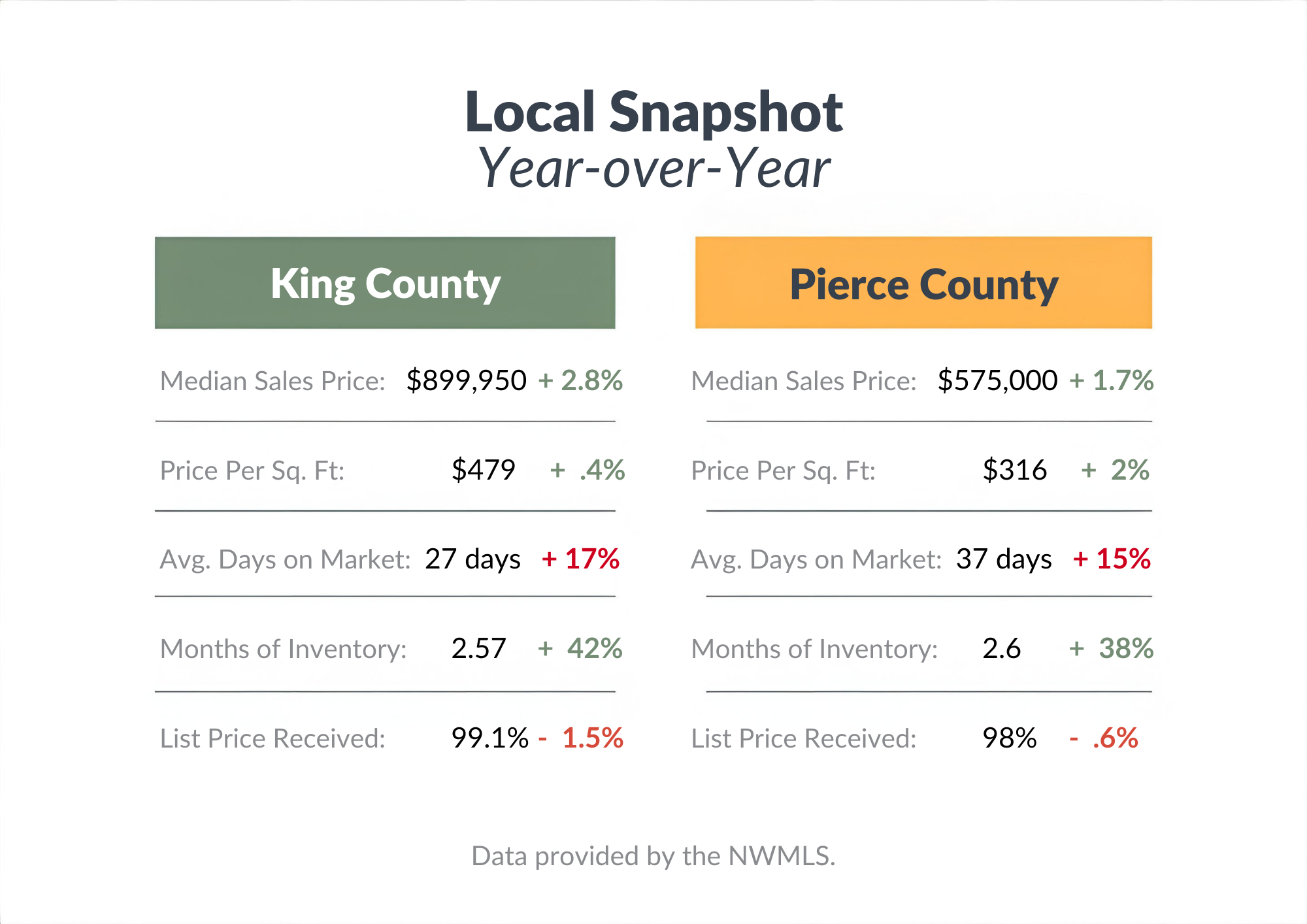

The overarching theme of 2025: Equilibrium:

Throughout 2025, the real estate market was defined by rising inventory and plateauing price appreciation, showing clear signals of a market finding its way towards balance and normalcy. Nationwide, year-over-year sales growth continues to trend upward in tandem with increased supply. Interestingly, this shift toward equilibrium has elicited both a unique mix of confidence and caution from buyers and sellers alike.

Inventory growth gave buyers leverage and time.

National pricing held firm in 2025, providing a stable backdrop for the modest appreciation we’re seeing in our local markets.

Nearly 4 in 10 listings saw price reductions.

The market continues to move away from extremes, toward equilibrium.

Buyers finally had the luxury of choice, while sellers faced more competition as pricing power softened. We have moved away from the era of frantic bidding wars and massive price escalations, thanks to the healthy influx of inventory. However, we still aren't in a "buyer's market". Demand continues to outpace available housing, keeping prices stable despite interest rates. As we look toward 2026, the market isn't necessarily "cooling off" it's simply growing up, offering a fairer, more predictable environment for everyone involved.

National Residential Snap Shot:

*Data provided by Housing Wire

Median list price: $419,950 (up 0.2% year over year)

Price per square foot: $209 (down 1.0% year over year)

Days on market: 84 days (up 9.1% year over year)

Active inventory: 757,763 homes (up 16.4% year over year)

Months of inventory: 2.8 months

Price reductions: 39% of active listings

Looking Ahead: 2026 Housing Market Outlook

As we look toward 2026, the big questions looming over the real estate market are: Is the long-awaited market recovery finally gaining momentum? If so, how will the influx of supply affect the bottom line for sellers? And can buyers finally expect some relief?

Inventory: Experts predict that 2026 inventory will grow by 10.9% nationwide. 2026 is poised to be the year where supply and demand finally tilt back toward “normal" levels, significantly increasing the options available to frustrated buyers.

Pricing: Experts anticipate a very modest 0.9% increase in home prices nationwide in 2026. While outright price declines are not the consensus, the market is inching closer to a scenario where sellers may need to be more aggressive with pricing to stand out in a crowded field.

Interest Rates: Forecasters expect mortgage rates to remain relatively stable, ending 2026 at approximately 6.15%. If this is the case, the stability in rates is expected to drive a 9% increase in existing home sales as more participants feel comfortable re-entering the market.

The Year of Opportunity:

We’ve moved past the chaos of bidding wars and extreme escalations, replacing that frantic energy with a functional market. In 2026, the luxury of choice is slowly returning for those looking to buy, while success for those listing their homes now depends on sharp pricing and great presentation. It’s a healthier, more predictable landscape, one where a "fair move" might be more possible for everyone involved.